|

MIDTERM ELECTION FACTS AND OBSERVATIONS

On November 6, 2018, U.S. voters will go to the polls to determine the winner of all 435 House seats and 35 of 100 Senate seats. While control of both chambers of Congress and influence over future policies may be at stake, do midterm elections have any effect on equity markets?

To find out, we researched more than 85 years of Standard & Poor 500 data, which indicated that congressional midterm elections do have identifiable impacts on the stock market. Though a diversity of other forces affect stocks throughout any year, careful scrutiny revealed four strong trends surrounding midterm elections. The diagrams below chart those trends.

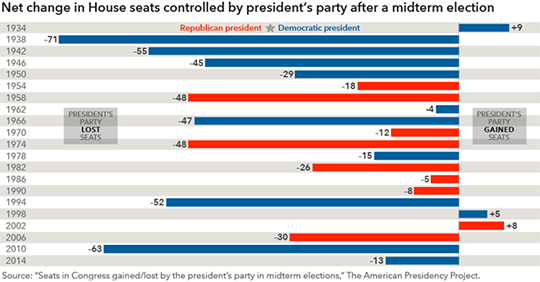

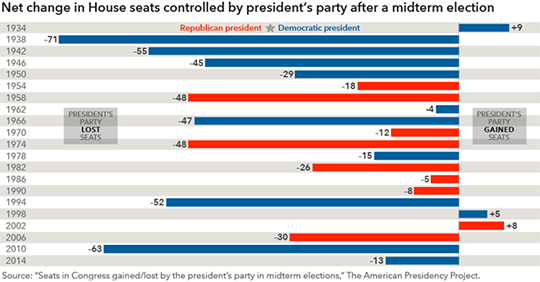

1. The President's party typically loses seats in Congress after midterm elections

Congressional midterm elections take place in a four-year cycle, two years into a four-year presidential term. Typically the political party opposite that of the President gains seats in Congress. Over the previous 21 midterm elections, since 1934, an average of 30 House of Representatives and Senate seats have gone to the opposing party. As seen in the chart below, the sitting President's party gained House seats only three times in this 80-year timespan (and gained both House and Senate seats only twice in that same timespan).

What accounts for this pattern? First, advocates of the party not represented in the White House are often more stimulated to generate stronger voter turnout for that party. Also, the President's approval rating usually falls two years into the first term, which can motivate swing voters and dissatisfied constituents to effect change by calling for stronger congressional representation from the opposing party to impose checks and balances on the President.

Throughout the history of Gallup polls, the party of a President with a job approval rating below 50% loses an average of 37 seats in the House at midterm, in contrast to an average 14-seat loss if the President's approval rating exceeds 50%. Republican President Donald Trump's 45% approval rating, just a month prior to this year's midterm elections, does not seem to put history in his favor. The Democrats must gain 23 seats in the House to obtain a majority there.

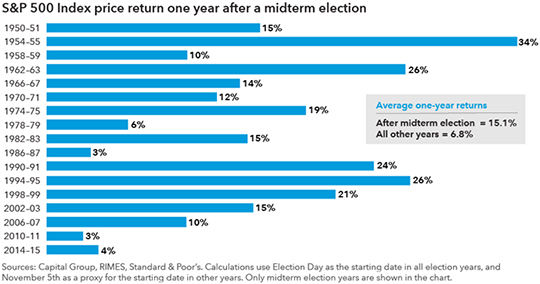

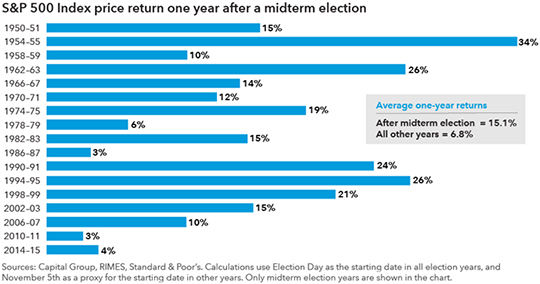

2. Markets usually rebound strongly in the year after midterm elections

Many investors are betting that the nine-year bull market will benefit from the midterm elections. Research shows that the year after the midterms has historically been the best of the four-year election cycle for stocks.

Since 1946, the S&P 500 Index has not dropped in the year following congressional midterm elections, but has increased an average of 15%, no matter which party won or lost a majority in Congress. By contrast, the index's average yearly gain since 1946 is 6.8%, and in 20 of those non-post-midterm-election years it has actually gone down.

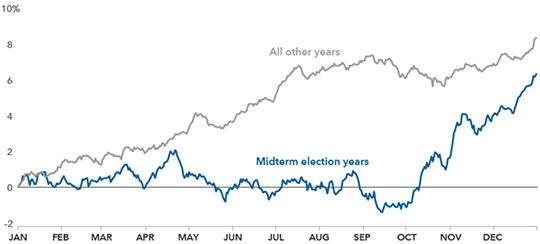

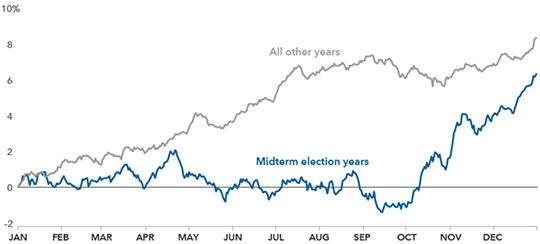

3. Markets also usually rebound in the short term after midterm elections

Stock markets tend to expand over long fiscal periods, so it seems that the price chart of a typical year of trading would generally go up as well. However, most midterm election year markets tend to move sideways, or even diminish during the middle part of the year, until a rebound begins just as the actual election occurs. Thus the recent stock sell-off, prior to a midterm election, is understandable.

The general supposition that uncertainty is the nemesis of markets seems applicable in this scenario. We tend to see less certainty about the election's aftermath and its effects on public policy earlier in the year. But as the prediction of election results becomes easier and more reliable in the weeks prior to the actual event, markets typically get bullish. And stocks generally continue to climb after the results are announced.

4. Even when the House majority shifts to the other party, markets increase

Most polls now predict that Republicans will lose enough House seats for a Democratic House majority. Would markets perform differently in this scenario than in years when the majority party simply lost seats, but otherwise kept control of Congress?

The House's majority party lost control of Congress in only three midterm elections within the past 60 years. In each of those three periods, stock markets were volatile early in the year but stocks began to rise as Election Day approached. Although no strong conclusions can be drawn from such a small sample size, history appears to show that a change of control in Congress isn't necessarily negative for the markets.

Conclusion

If historical trends hold, stocks should get a boost after the midterm elections, as investors will be contending with one less market uncertainty. In a survey of roughly 300 institutional investors, 18% of respondents identified the midterm elections as the market's greatest risk and opportunity simultaneously. History has also shown that in congressional midterm election years the S&P 500 index has increased 7.5% on average for Q4.

As our staff of investment professionals at WT Wealth Management examined different aspects of the U.S. midterm elections and their potential effects on fiscal policy, the economy, and investments, one common theme emerged: the need to focus on fundamentals in an uncertain environment.

The U.S. economy has steadily grown in 2018 with 4.2% GDP growth in Q2, supported by gains in consumer spending and business investment. This was followed by 3.5% GDP growth in Q3, supported by modest inflation and continued strength in consumer spending. Measures of consumer confidence are tracking at 18-year highs, and retailers are bullish ahead of the holiday shopping season, as early estimates predict 3-5% increases in consumer spending. These are good signs for a bull market as it enters a historically robust period for stocks.

We are convinced that the economic and market conditions that have determined the performance of key asset categories in 2018 will remain relevant after the last election results are in place and the emotion surrounding the 2018 congressional midterm elections dissipates. We affirm our belief that, as markets respond to this year's midterm election according to historical trends, recent stock sell-offs are likely to be followed by a meaningful rally through the balance of this year and well into 2019.

While it is never possible to predict the future with 100% accuracy, history does teach powerful lessons.

Sources

Garmhausen, Steve.

"Why the Election Will Boost Stocks." Barron's, October 4, 2018.

View Source

Holmes, Frank.

"The Best Time to Prepare is When the Bull Runs." U.S. Global Investors, September 21, 2018.

View Source

Jones, Jeffrey M.

"Midterm Seat Loss Averages 37 for Unpopular Presidents." Gallup, September 12, 2018.

View Source

Murse, Tom.

"Why the President's Party Loses Seats in Midterm Elections." ThoughtCo. Lifelong Learning,

View Source

Martini, Giulio.

"U.S. Midterm Elections: Investment Views from Our Experts." Lord Abbott Market View, October 1, 2018.

View Source

McKenna, Will, and Whitney Kisling.

"U.S. Equities: Can Midterm Elections Move Markets? Five Charts to Watch." Capital Ideas, September 12, 2018.

View Source

Prang, Allison, and Akane Otani.

"Midterms Are a Boon for Stocks-No Matter Who Wins." The Wall Street Journal, October 4, 2018.

View Source

Click Here to View our Disclosure |