When I started in this business in 1989, my mentor preached that the economy is not the stock market and the stock market is not the economy. He described the market as a bucking bull, always doing its best to throw you off and make you exit the market at the wrong time before the ride is over. The economy, on the other hand, is almost always on a smoother, more predictable glidepath.

We get it. It's been a rough 5 months to start 2022. This is the 3rd worst start to the year for the S&P 500 since 1945 and the worst since 1970. For the tech industry, it's the worst start ever.

(1) More than $10 trillion of "paper wealth" has been lost since the start of the year.

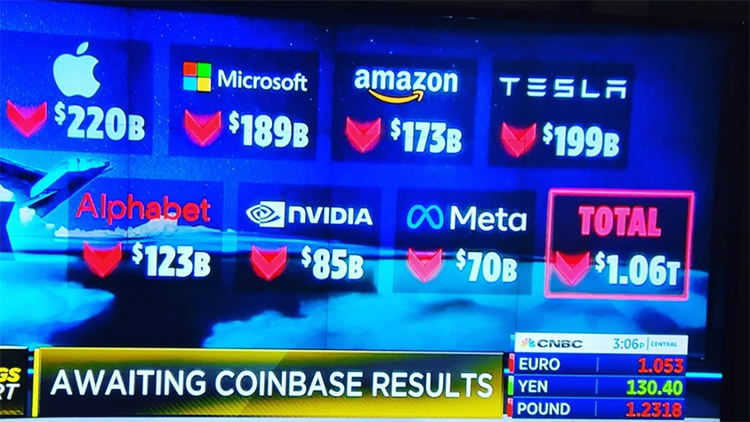

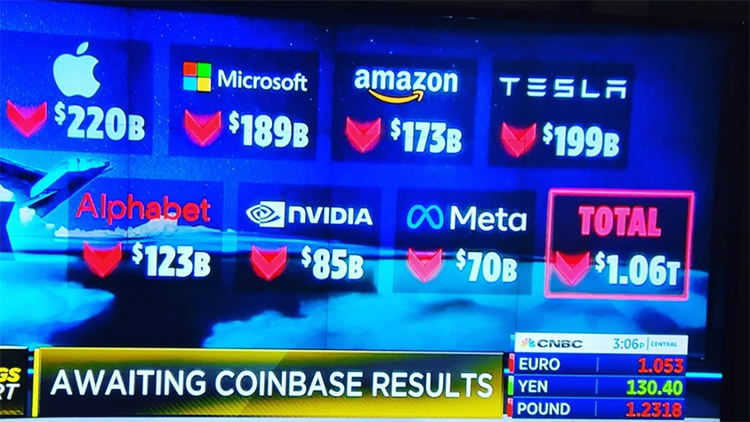

As of May 17, 2022, the top 7 names in the S&P 500 had lost over $1 trillion in market capitalization so far this year.

CNBC May 17th, 2022

Both the Nasdaq and Russell 2000 small caps are in bear market territory (i.e., down by at least 20%). The S&P 500, at least temporarily, descended below the same threshold for several hours on Friday May 20th, prior to the market's brief recovery at the end of May.

At WT Wealth Management, we believe the primary culprit for this year's correction is the liquidity drain from the Federal Reserve's monetary tightening program that is currently underway – in other words, froth being blown off the pint.

Inflation has gone from transitory to persistent. The Federal Reserve, as confirmed by its Chair Jerome Powell, "will be undeterred in their battle against inflation" before it becomes embedded in the economy. The Fed also recently conceded that it may have to allow more economic harm to corral inflation. As a result, the odds of recession, as polled by Bloomberg's Consensus of Economists, jumped to 27.5% in April, up from 20% in March.

(2)

Not much has been spared

The Fed tightening has delivered a one-two punch to stocks and bonds. Through the first five months of 2022, the two asset classes are down double-digits simultaneously—a "feat" that has not occurred since 1994. Additionally, speculative segments of the market, such as crypto, have been hit particularly hard. Sectors with high valuations, such as cyber-security, semiconductors and cloud computing software, have garnered much media attention as they struggle to perform.

Everything is Better with Perspective

Equity markets are cyclical, often predictably so. Historically, a 5-year time-period has produced a discernable pattern of 3 positive years, one flat year and one down year. The past 5 years have followed that pattern: 2017, 2019, 2020 & 2021 were all positive while 2018 had a small drawdown (essentially flat). 2022 now appears to be our anticipated down year.

| DJIA, S&P500, NASDAQ Yearly Returns Comparison |

| Year |

Dow Jones |

S&P500 |

NASDAQ |

| 2009 |

18.82% |

23.45% |

43.89% |

| 2010 |

11.02% |

12.78% |

16.91% |

| 2011 |

5.53% |

0.00% |

-1.80% |

| 2012 |

7.26% |

13.41% |

15.91% |

| 2013 |

26.50% |

29.60% |

38.32% |

| 2014 |

7.52% |

11.39% |

13.40% |

| 2015 |

-2.23% |

-0.73% |

5.73% |

| 2016 |

13.42% |

9.54% |

7.50% |

| 2017 |

25.08% |

19.42% |

28.24% |

| 2018 |

-5.63% |

-6.24% |

-3.88% |

| 2019 |

22.34% |

28.88% |

35.23% |

| 2020 |

7.25% |

16.26% |

43.64% |

| 2021 |

18.73% |

26.89% |

21.39% |

www.1stock1.com/1stock1_142.htm

Summary

Since the Great Financial Crisis of 2008, investors have enjoyed a relatively easy 13-year run. Perhaps we have all become temporarily complacent about the historic volatility seen by investors. While the S&P 500 has produced a compelling average annual return of just over 10% since 1957, we're all in the process of "regaining" the experience that bulls don't trot, they buck.

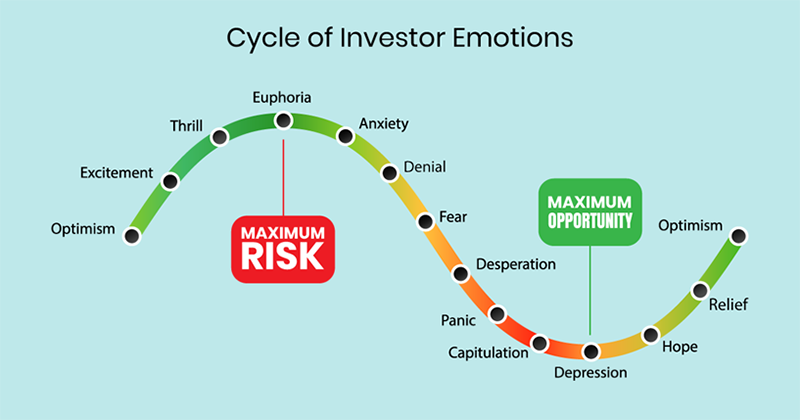

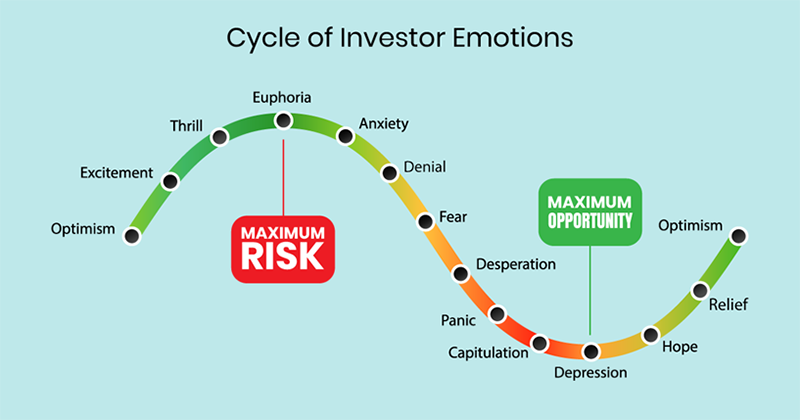

Sadly, there is no perfect signal of when a bear market ends. If there is a silver lining to the market's carnage, it's that investor sentiment has turned quite sour. This often serves as a contrarian indicator of maximum opportunity.

Deep corrections function much like control/alt/delete on your computer. We're resetting expectations and valuations, which is healthy, even required, for the next move higher.

The bull riders that hold on are ultimately rewarded with bounce-back gains that can dim the painful memories of the past.

We understand the stress that inflation and volatile markets are causing. We are here to help and stand ready to talk at any time. Please continue to reach out for information, comfort and guidance.

Sources

- Dow, S&P 500 head for worst start to a year since 1970 — for tech it's the worst in history

MarketWatch.com

- Summers Sees Consensus Building Toward Inevitable U.S. Recession

Bloomberg.com